Trikl let's people learn how they can build their wealth in the easiest manner possible!

Trikl lets you:

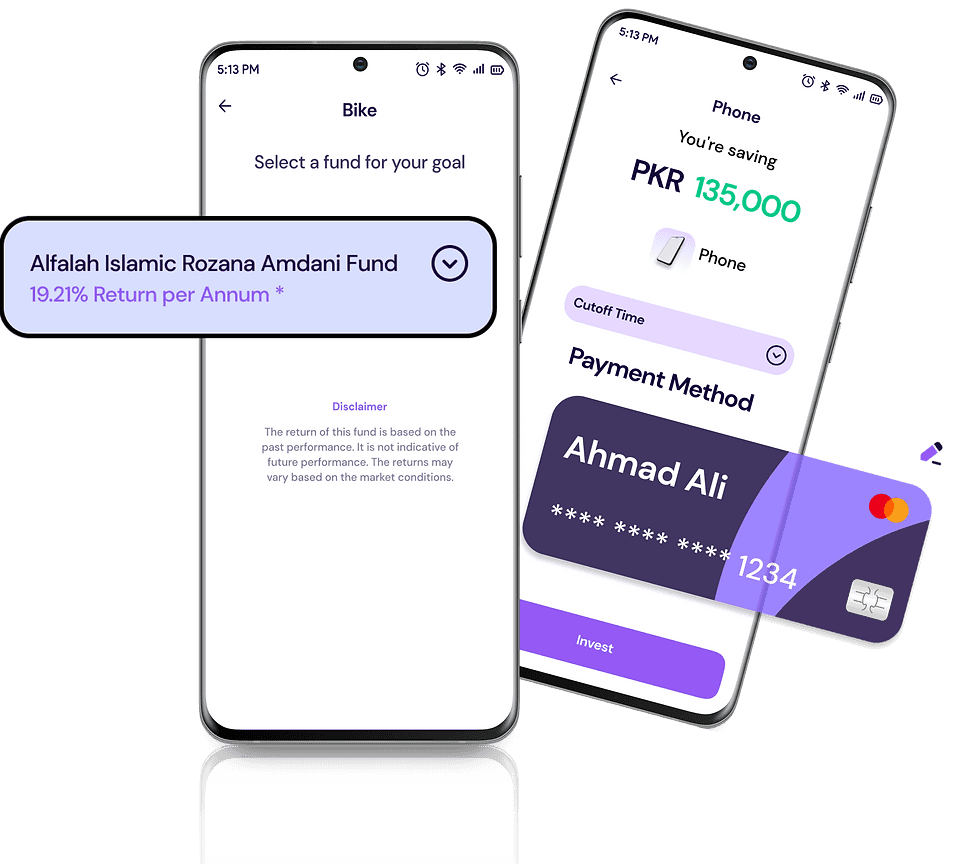

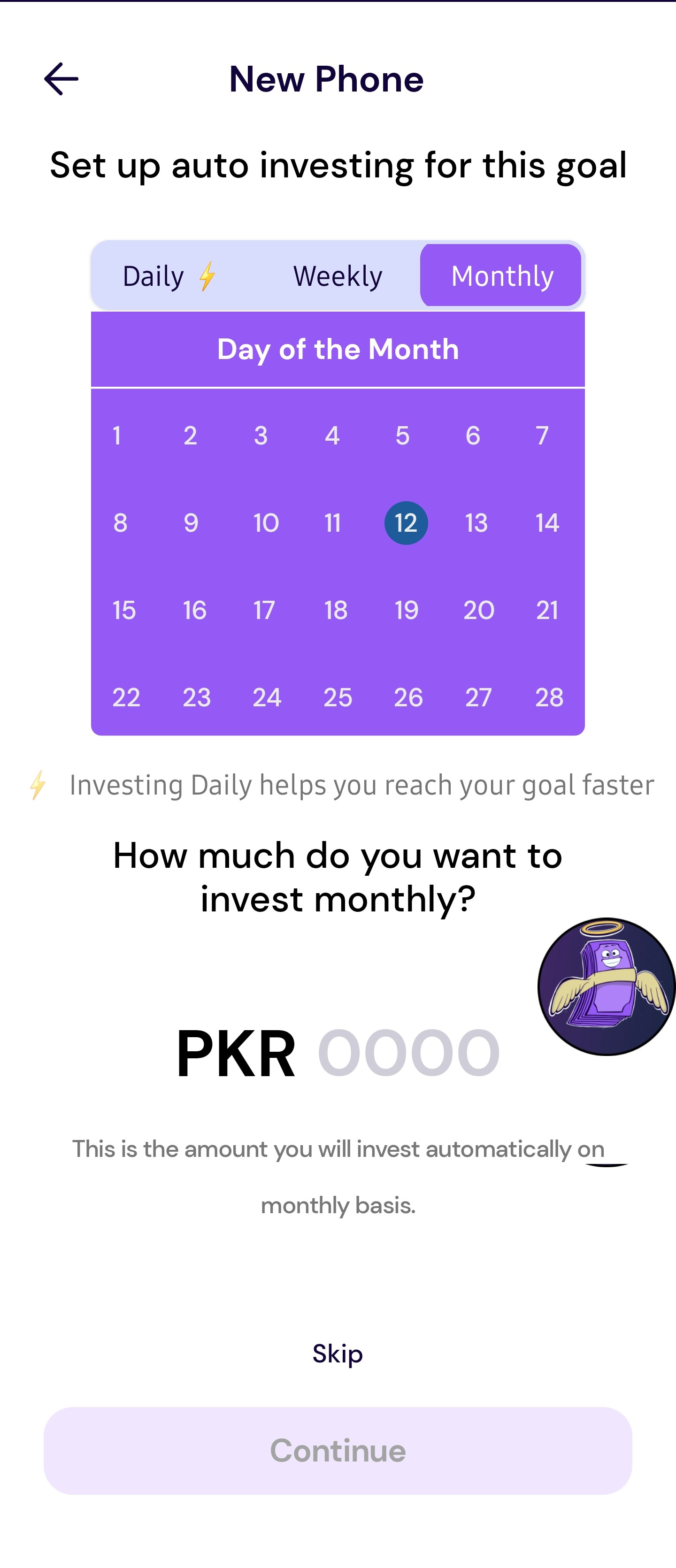

1. Automate your investments

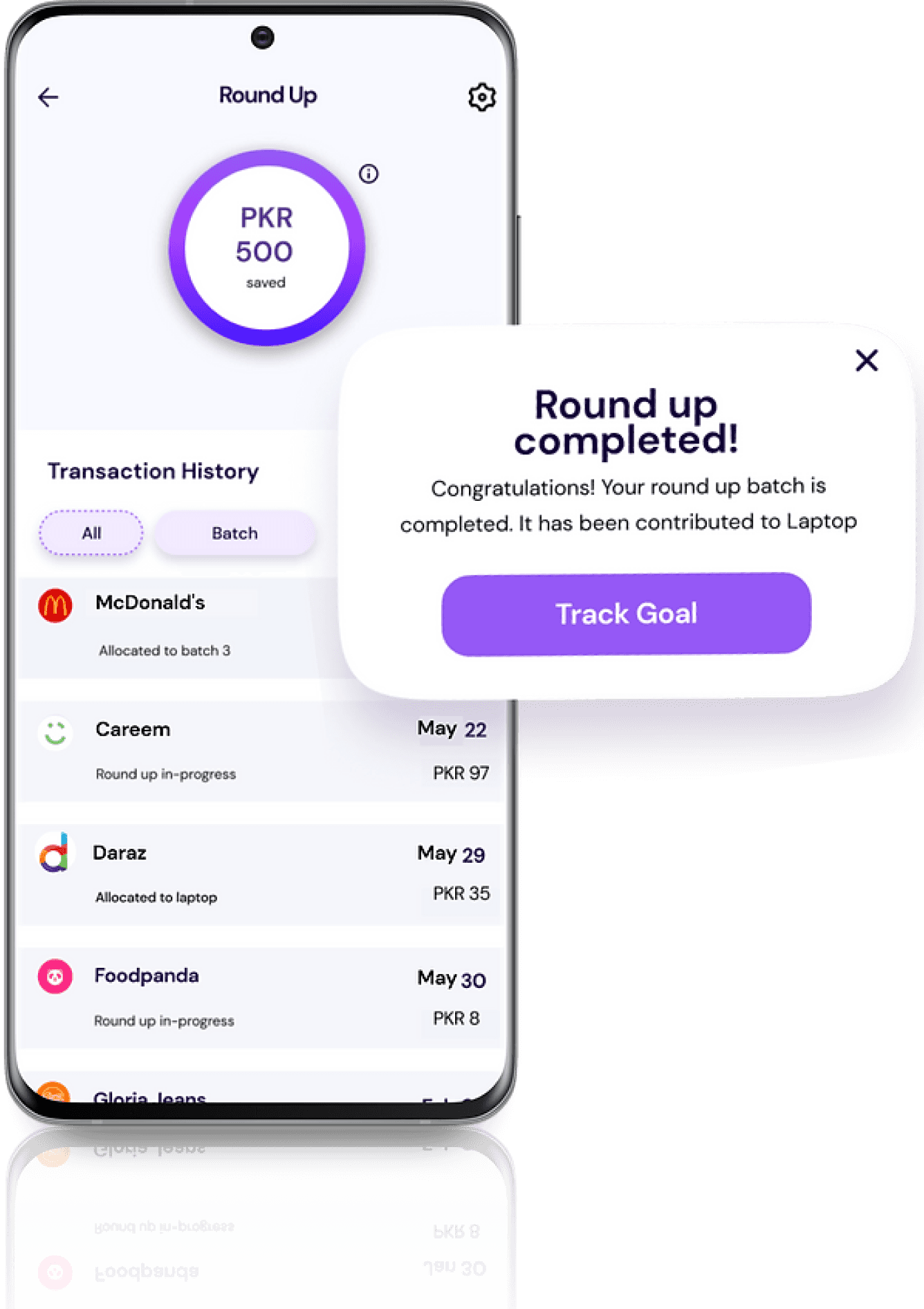

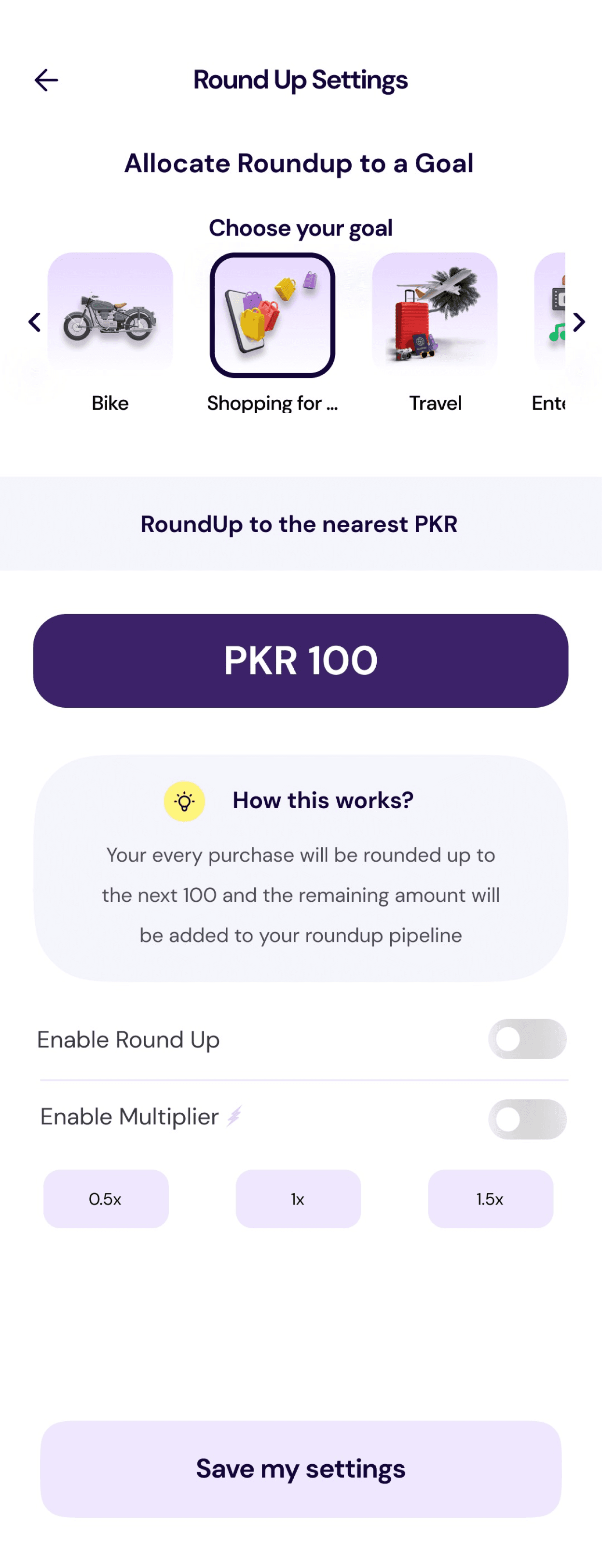

2. Round up your lose change and add it to your investments, automatically

Would you be interested in using an app that automated your investments according to a schedule of your choice?

Yes

Maybe

No

Would you like to learn more about investments while using an investments app?

Yes

No

Maybe

Would you trust an investment app?

No

Maybe

Yes

Do you have any past investing experience?

No

Yes

Stock Market

Age :

26

Status :

Single

Occupation :

Employed

Character trait :

Gentle, Cautious

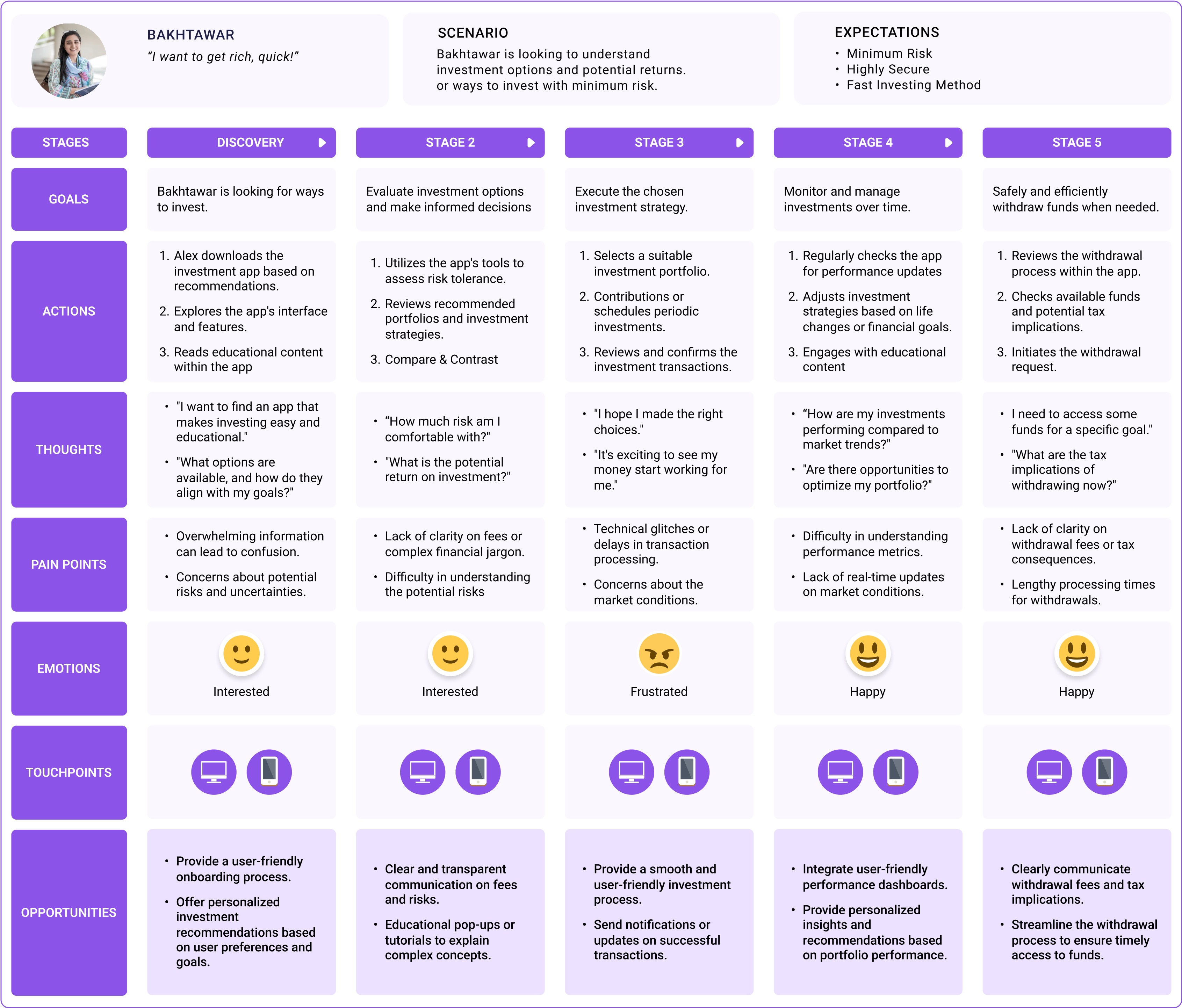

Daud is a dedicated professional with a passion for volunteering. He is currently seeking new opportunities to build wealth. He wants to find ways he can reinvest into portfolios and earn a passive income if possible.

Age :

26

Status :

Single

Occupation :

Employed

Character trait :

Gentle, Cautious

Daud is a dedicated professional with a passion for volunteering. He is currently seeking new opportunities to build wealth. He wants to find ways he can reinvest into portfolios and earn a passive income if possible.

Title

Display

Headline 1

Headline 2

Body 1

Body 2

Label

Footnote

Font size

40 px

36 px

28 px

24 px

18 px

16 px

12 px

10 px

Accent

Button, Icons, Highlights

8C53E8

BBE4FB

Text

Headings, Paragraph

Ef fects

Boarders, Shadows

737687

9C9EAA

Background

F5F5F5

FFFFFF

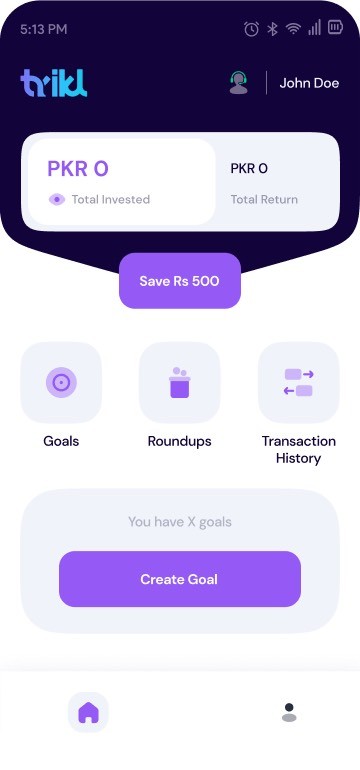

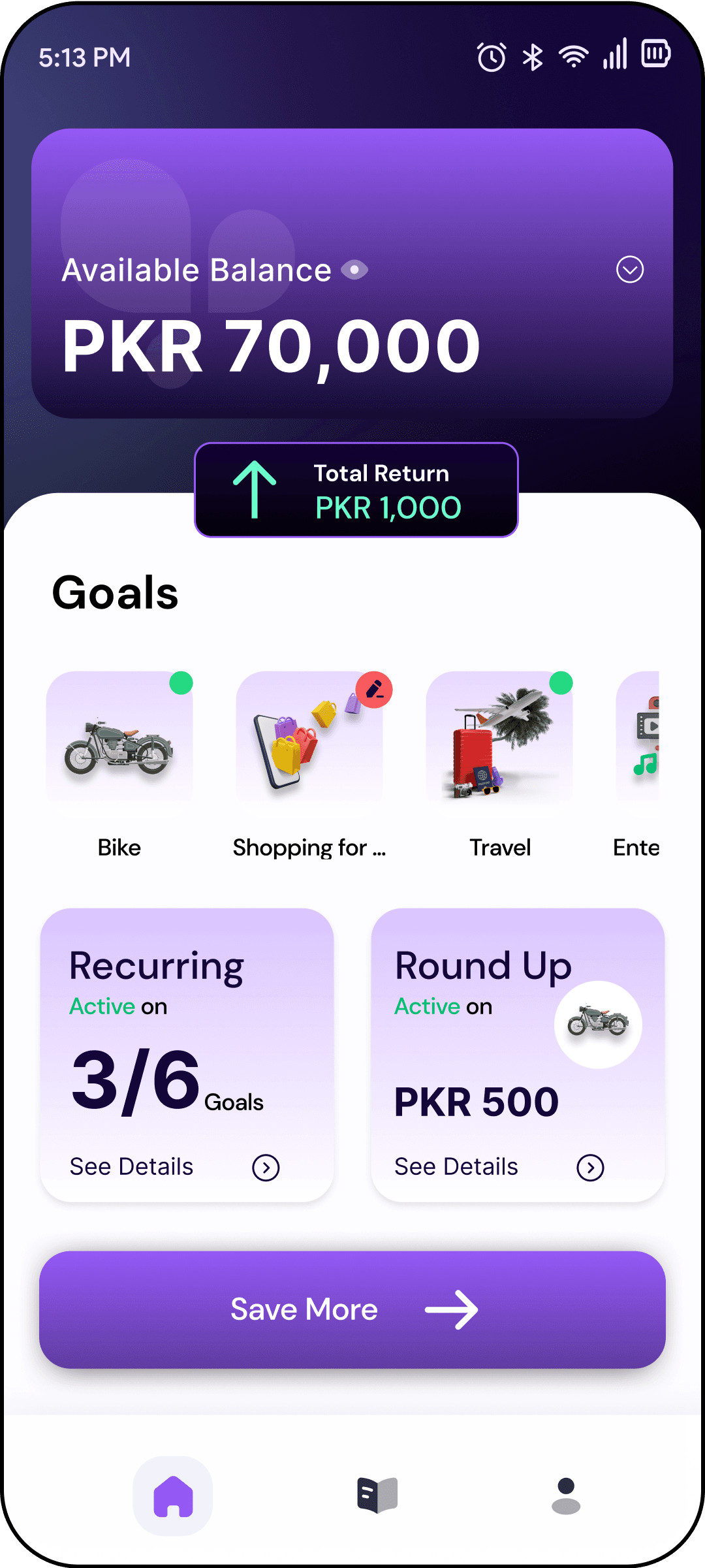

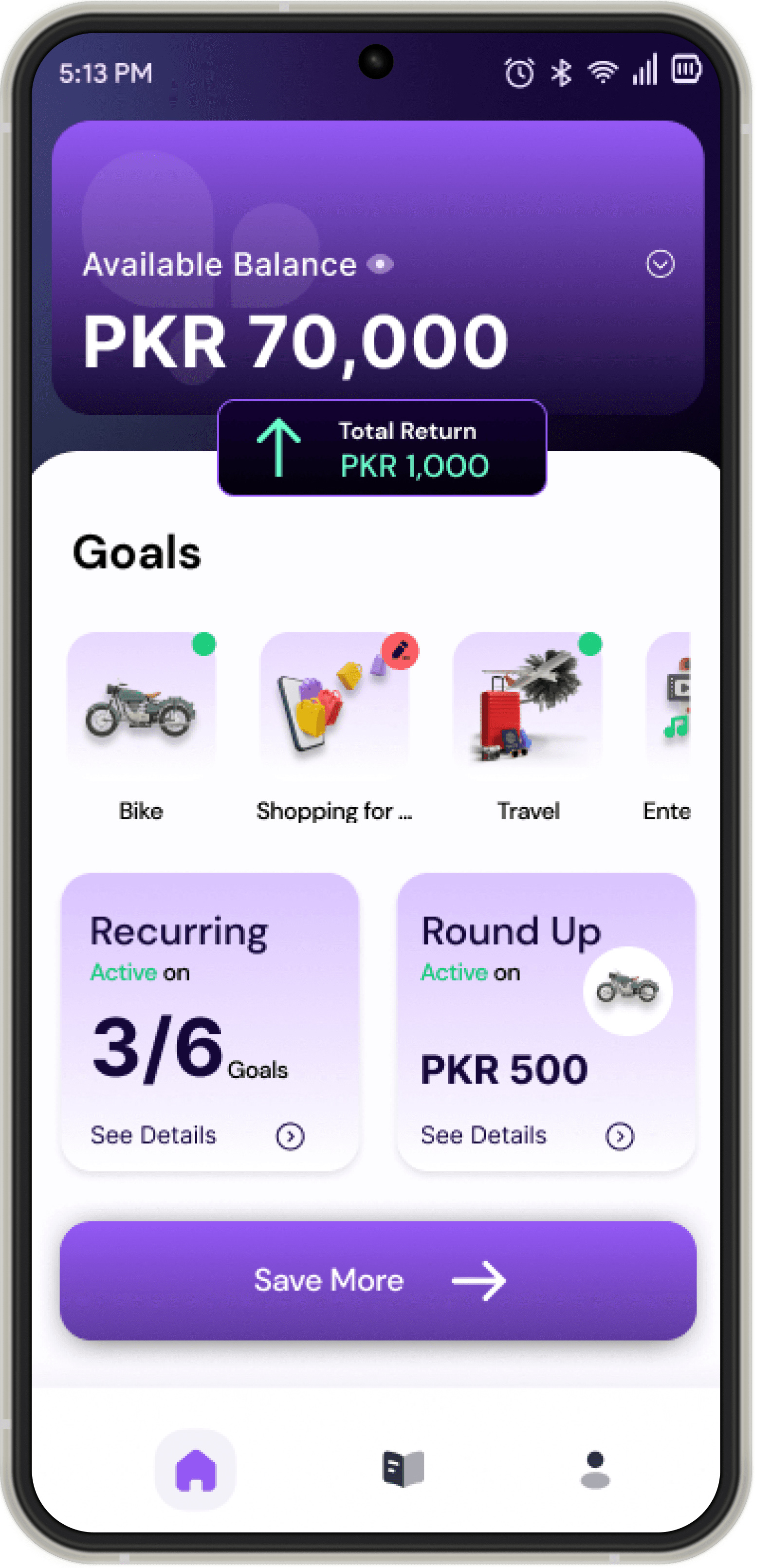

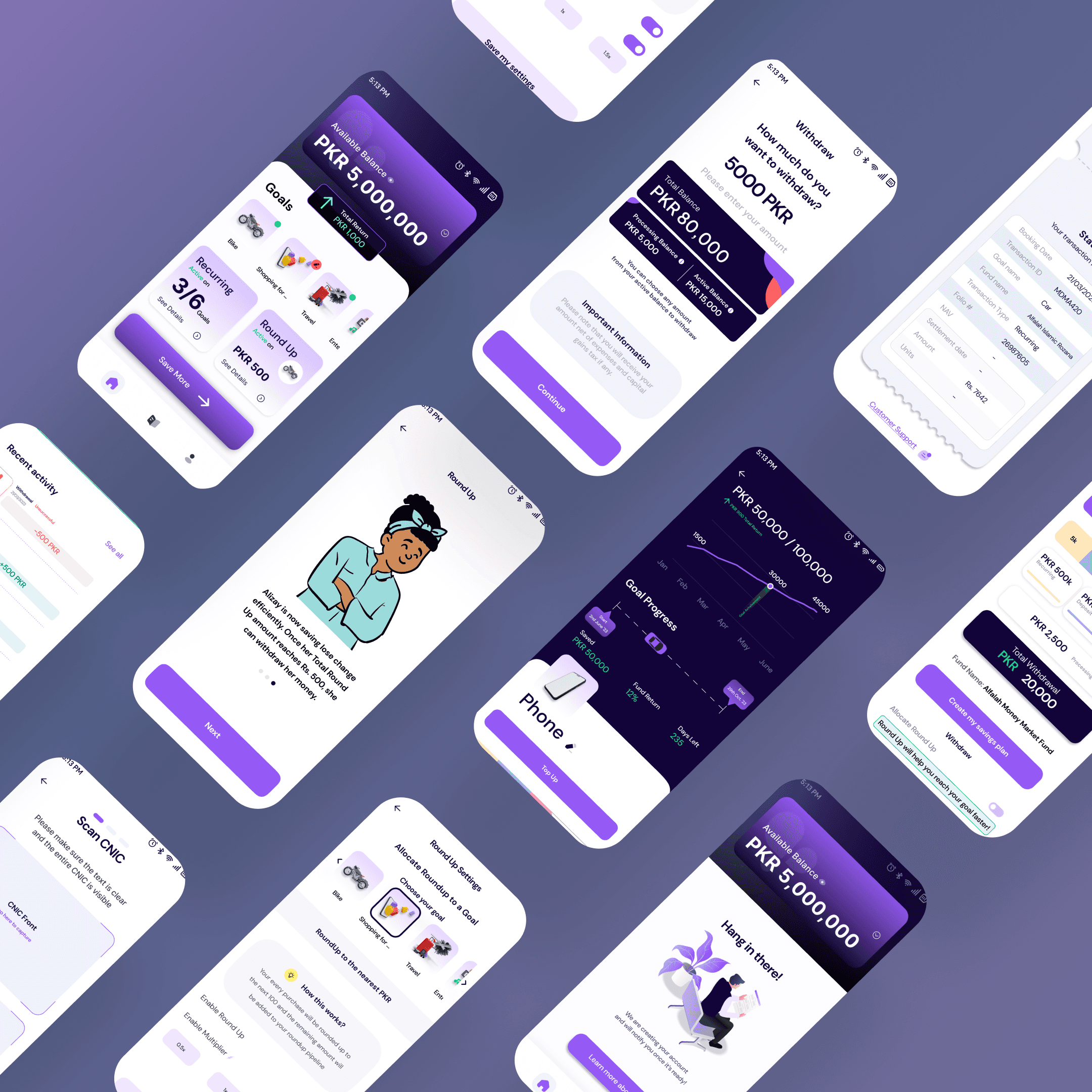

1

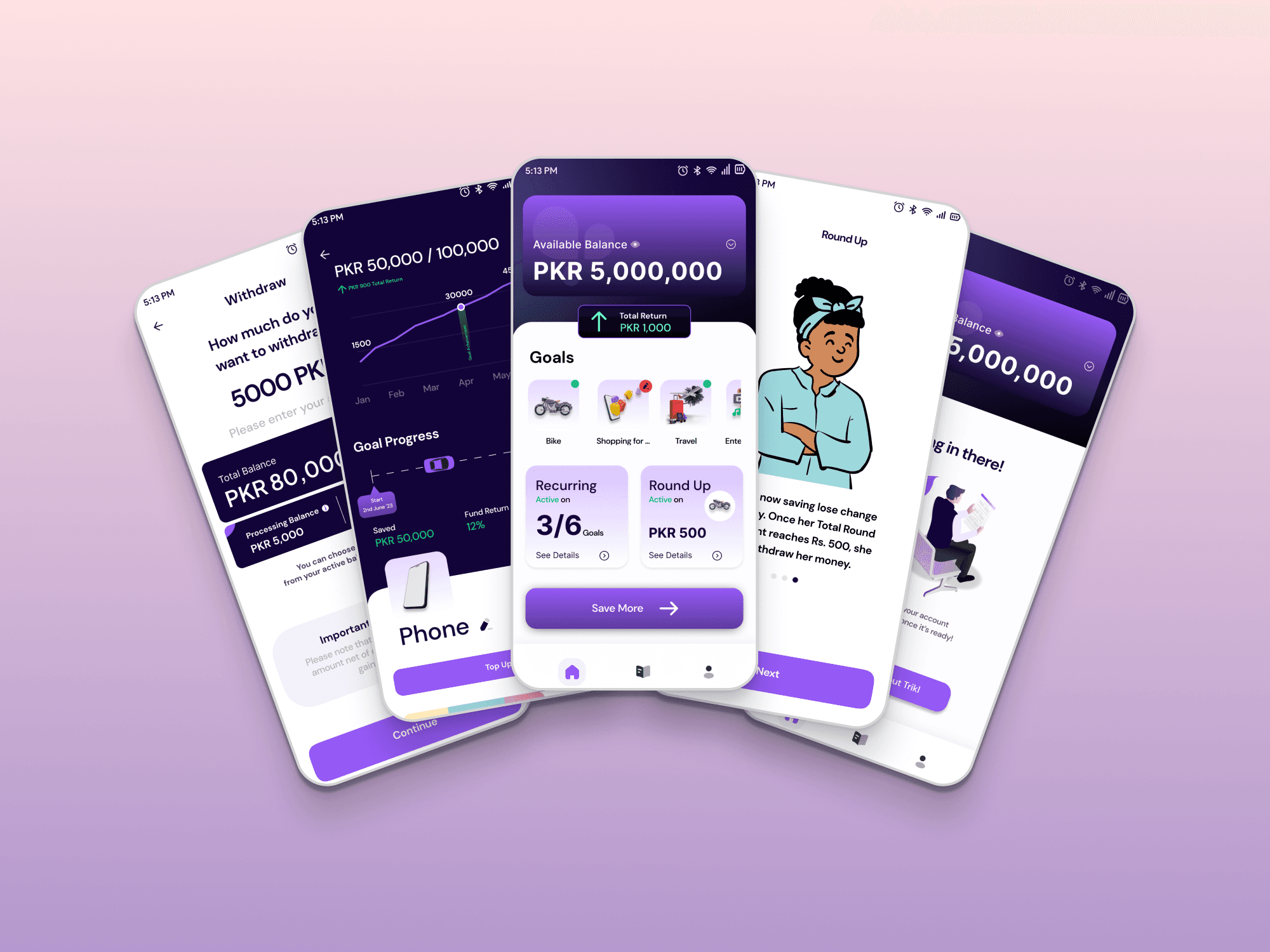

Balance

The top section is dedicated to the balance, with a drop down option to see different kinds of balances.

2

Return

The total return earned so far is highlighted.

3

Goals

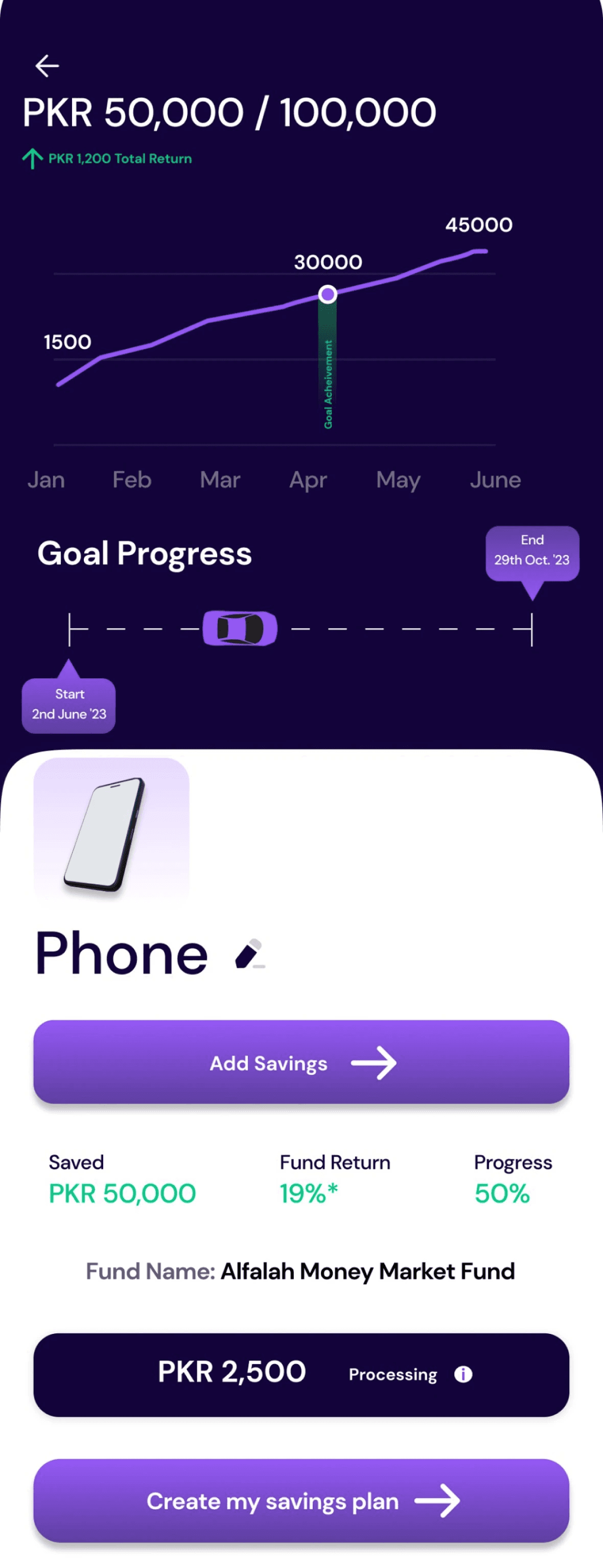

Goals are basically the investments you’ve made so far. The list is swipe able and easy accessible for any changes or details.

4

Automation

Recurring & Round Ups are automation features. Their importance, results and accessibility was top priority.

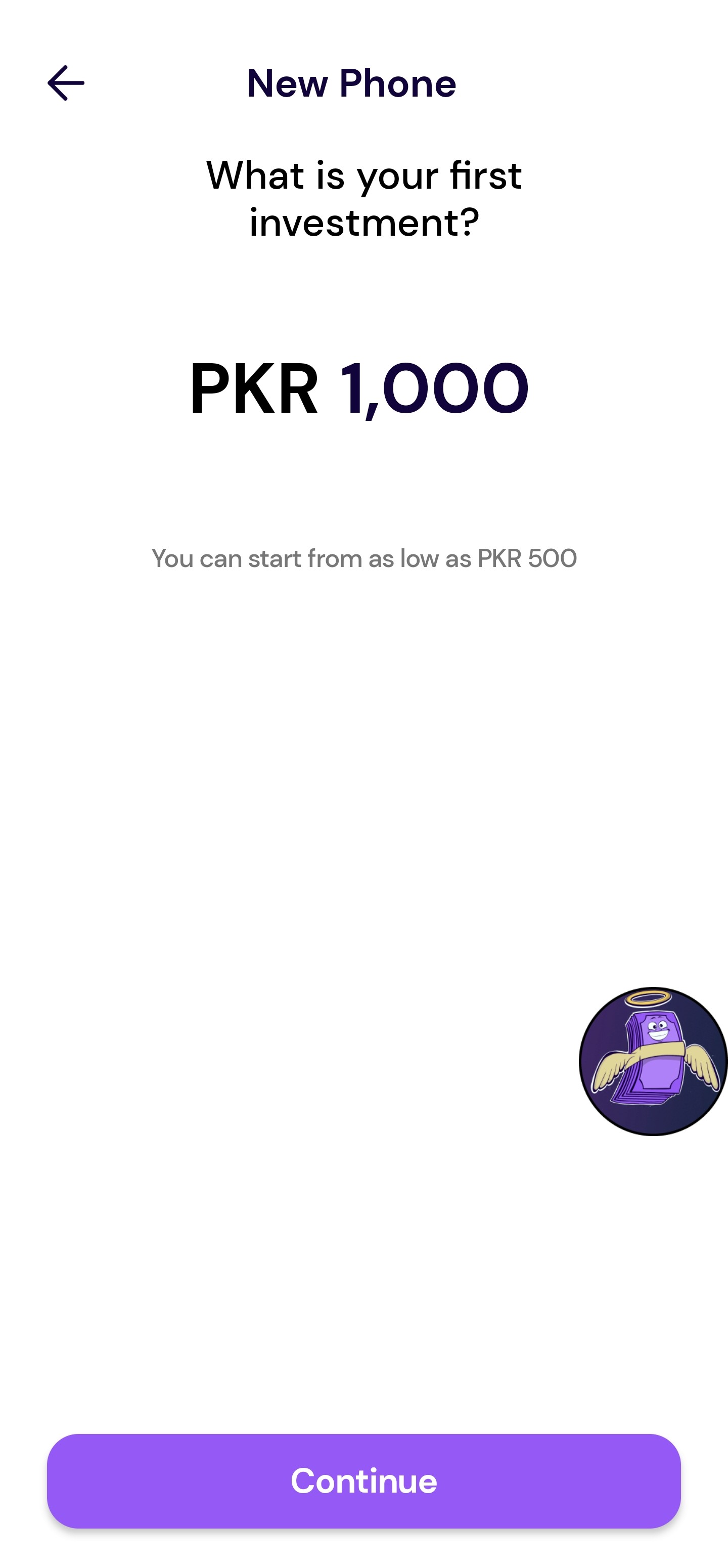

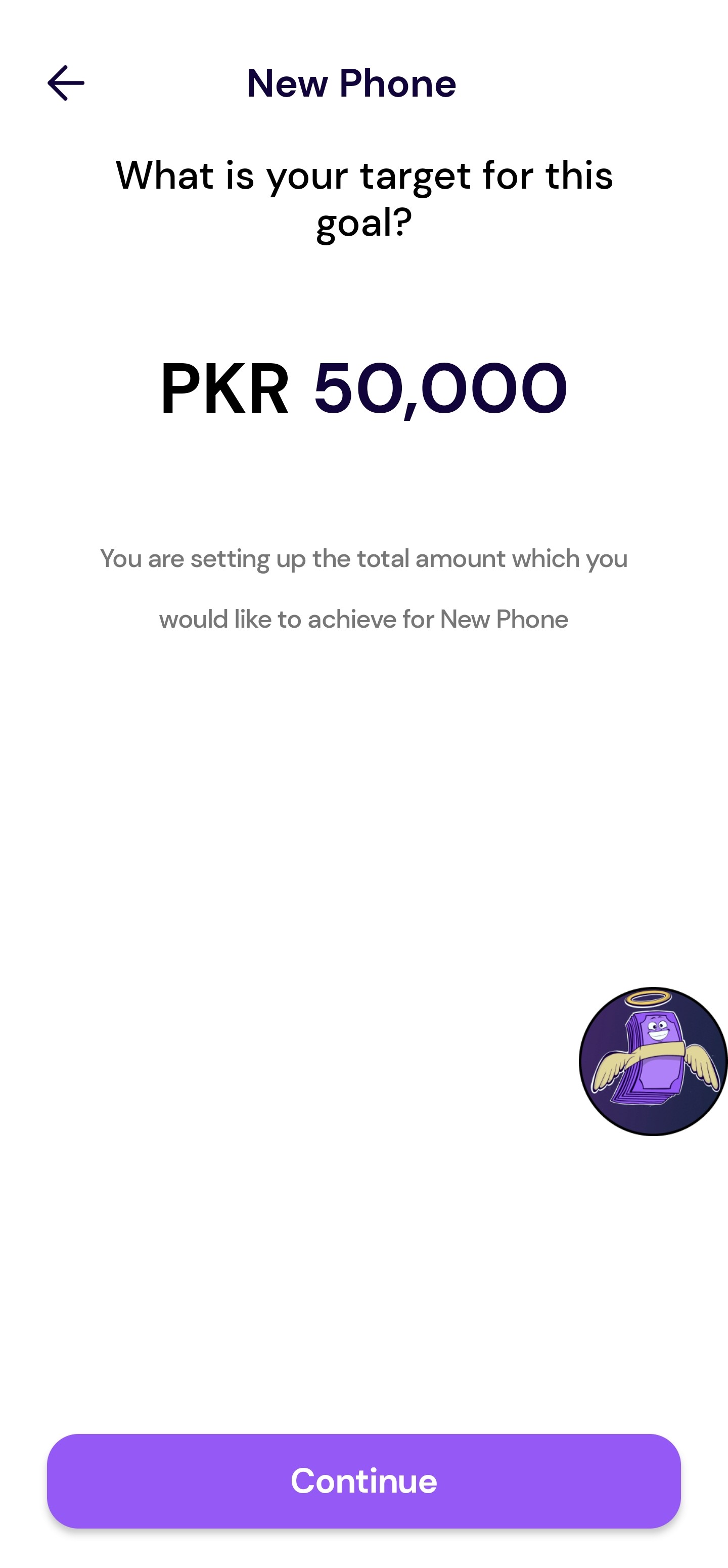

5

Save More

Continue your goals (investments) or even start a new one with a single tap.

6

Nav Bar

The Nav Bar makes it easy to switch between investing and learning mode, and also accessing your profile for more details and settings.